The Manifest Hails The ProActive Technology Group as New York’s Most Reviewed B2B Leader for 2024

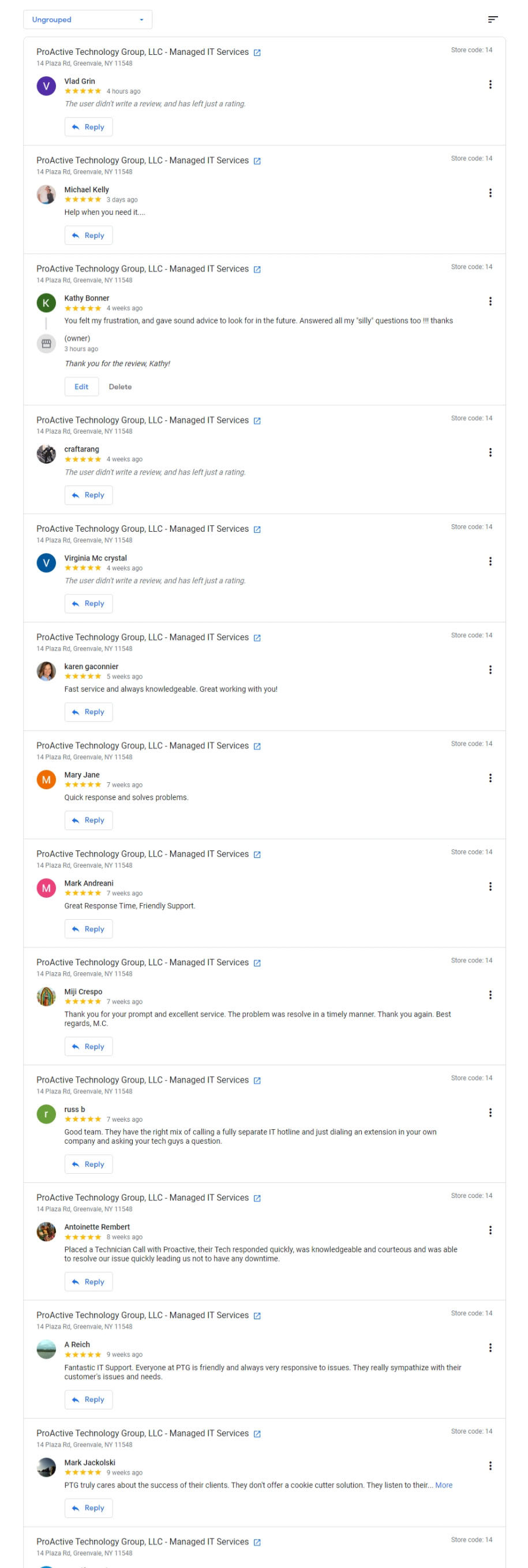

During the annual The Manifest Company Awards, The ProActive Technology group was officially spotlighted as one of the most reviewed and recommended B2B leaders in New York City!

.jpg)

.jpg)